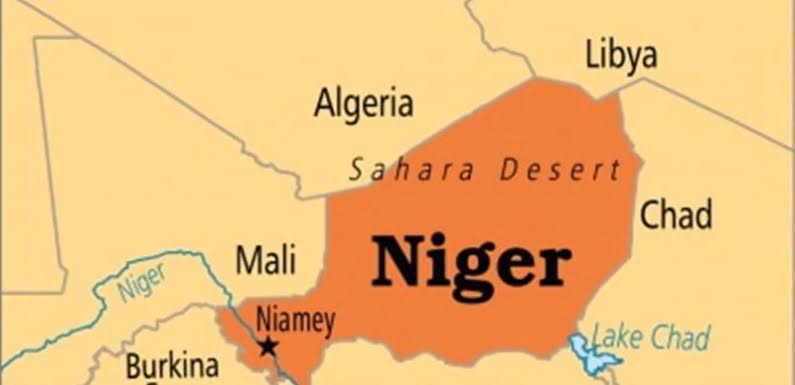

Niger defaults up to half billion in debt payment

It has been reported that the Republic of Niger is facing escalating debt defaults, with the country falling behind on payments totaling $519 million since the military coup in July.

The West African debt management agency, UMOA-Titres, reported a recent default of 13.4 billion CFA francs ($22 million). The amount brings the total default to about $519 million and emphasizes the ongoing economic challenges in Niger, exacerbated by regional sanctions.

The missed repayment, due on February 16, triggered concerns as Niger has previously missed payments in August, November, and January. According to UMOA-Titres, the defaults are connected to sanctions imposed by the Economic Community of West African States (ECOWAS) and the West African Economic and Monetary Union (UEMOA).

The debt management agency issued a statement affirming their vigilant monitoring of the situation in collaboration with relevant institutions.

Recall that sanctions were initially enforced in 2023 following the coup that ousted President Mohamed Bazoum. The July 30 coup prompted ECOWAS and UEMOA to suspend Niger from regional financial markets. The repercussions were severe, including the freezing of external bank assets, suspension of financial transactions with West African countries, and the cancellation of a planned 30 billion CFA franc ($51 million) bond issuance by the Central Bank of West African States (BCEAO).

International aid, a significant portion of Niger’s annual budget, was halted, leaving the country grappling with economic hardship. Neighboring nations closed their borders, electricity supply was disrupted, and over 70 percent of power sourced from Nigeria was severed, as West Africa Weekly earlier reported.

Despite stringent sanctions, the government consolidated its power and announced its departure from ECOWAS alongside Mali and Burkina Faso. In further retaliation, the government of the Republic of Niger placed a ban on all commercial and international flights coming from or going to Nigeria. The three Junta nations are now reportedly contemplating discontinuing the use of the CFA currency. It is unclear, at the moment, how Niger intends to tackle its debt crisis.

Read more: Burna Boy Thrills Fans at Spill Gate Festival

About The Author

Related Articles

Tinubu Government Delays Release of Signed Tax Acts to the Public

Four days after President Bola Tinubu announced the signing of four tax...

ByMayowa DurosinmiJune 30, 2025As Tinubu Urges Africa-Caribbean Unity in Saint Lucia, Over 272 Nigerians Killed in June Alone

While Nigerians deal with deadly violence, worsening hunger, and mass flooding, President...

ByWest Africa WeeklyJune 30, 2025You Can’t Tax a Dead Economy: Nigeria Is Suffocating Under Its Own Policies

As Nigeria’s Central Bank clings to its benchmark interest rate of 27.5...

ByWest Africa WeeklyJune 30, 2025“Wike is Not a Blessing to Us, He’s a Disaster” — Workers Protest in Nigeria’s Capital Over Unpaid Wages, Poor Working Conditions

Staff members of the Federal Capital Territory Administration (FCTA) in Abuja barricaded...

ByOluwasegun SanusiJune 30, 2025

Leave a comment