The Central Bank of Nigeria (CBN) issued an order directing commercial banks to charge customers a 0.5% deductible levies to help fund the National Cybersecurity Fund for the Office of the National Security Adviser (ONSA) to the President on tackling counter-terrorism.

This directive by the CBN follows the order of the NSA, which requested on Friday that the Cybercrimes (Prohibition, Prevention, etc.) Amendment Act 2024 be fully implemented.

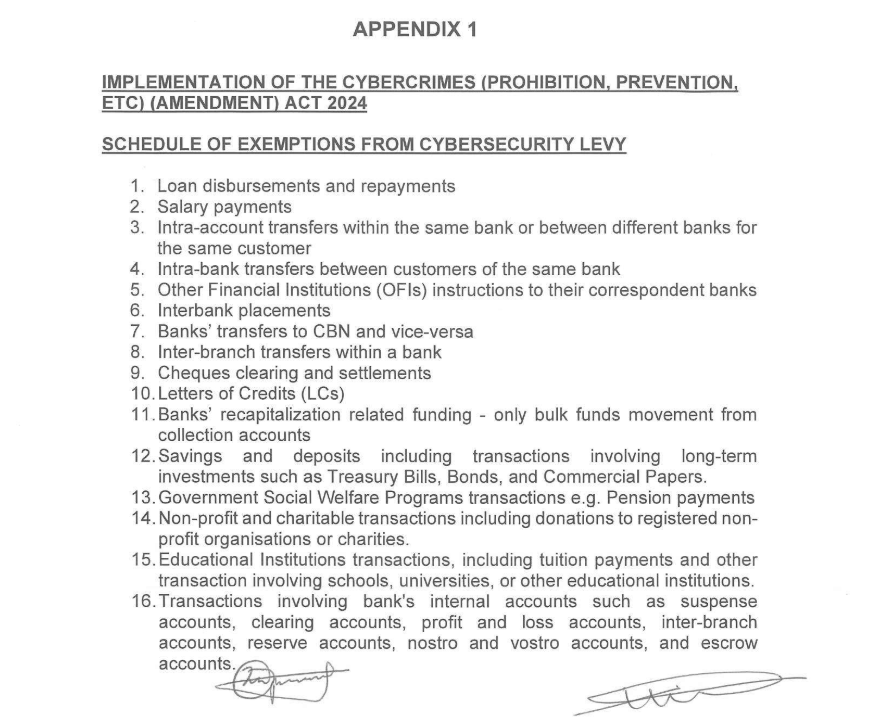

Following Ribadu’s order, the CBN has issued a directive to all commercial banks operating in Nigeria to start charging a cybersecurity levy on all transactions with few exemptions.

In a circular issued on Monday, the CBN has made it clear that this directive applies to all banks, financial institutions, and payment service providers. This means that all these entities are now obligated to implement the directive.

The levy shall be applied at the point of electronic transfer origination, then deducted and remitted by the financial institution. The deducted amount shall be reflected in the customer’s account with the narration, ‘Cybersecurity Levy’, says CBN.

However, this directive also applies to letters dated 25 June 2018 and October 5, 2018, referenced in the CBN circular as BPS/DIR/GEN/CIR/05/008 and BSD/DIR/GEN/LAB/11/023, respectively.

The letter and circular follow the implementation of Cybercrimes (Prohibition, Prevention, etc.) Amendment Act 2024 under the provision of Section 44 (2)(a) of the Act, which states:

A levy of 0.5% (0.005), equivalent to half per cent of the value of all electronic transactions by the business specified in the Second Schedule of the Act, is to be remitted to the National Cybersecurity Fund (NCF), which shall be administered by the Office of the National Security Adviser (ONSA).

Meanwhile, the CBN, in recent times, in all efforts to sanitise the financial sector, issued several directives, one of which barred fintech companies, including Opay, Palmpay, etc., from onboarding new customers and a ban on crypto-related transactions, all of which have received public criticism bothering on financial restraints.

About The Author

Mayowa Durosinmi

author

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

Mayowa Durosinmi

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

Related Articles

Tinubu Government Delays Release of Signed Tax Acts to the Public

Four days after President Bola Tinubu announced the signing of four tax...

ByMayowa DurosinmiJune 30, 2025As Tinubu Urges Africa-Caribbean Unity in Saint Lucia, Over 272 Nigerians Killed in June Alone

While Nigerians deal with deadly violence, worsening hunger, and mass flooding, President...

ByWest Africa WeeklyJune 30, 2025You Can’t Tax a Dead Economy: Nigeria Is Suffocating Under Its Own Policies

As Nigeria’s Central Bank clings to its benchmark interest rate of 27.5...

ByWest Africa WeeklyJune 30, 2025“Wike is Not a Blessing to Us, He’s a Disaster” — Workers Protest in Nigeria’s Capital Over Unpaid Wages, Poor Working Conditions

Staff members of the Federal Capital Territory Administration (FCTA) in Abuja barricaded...

ByOluwasegun SanusiJune 30, 2025