The Naira has been omitted from the International Monetary Fund’s (IMF) Representative Exchange Rates for Selected Currencies for June 2024. This exclusion shows Nigeria’s ongoing challenges in stabilising its currency and economy.

The IMF’s list, which includes currencies from various countries such as the Algerian dinar, Botswana pula, Mauritian rupee, and South African rand, was published on the IMF’s official website on Tuesday. The absence of the Naira comes as Nigeria continues to grapple with fluctuating exchange rates and economic instability.

Economic experts suggest that high inflation, currency volatility, and a decline in foreign investment have exacerbated Nigeria’s financial woes.

Jonathan Thomas, an economic expert, remarked,

The absence of the Naira from this list may further undermine investor confidence in Nigeria’s economy. Nigeria’s economic struggles have been ongoing, with the country facing a daunting task in stabilising its currency and revitalising its economy.

The IMF’s Representative Exchange Rates list is a benchmark for international trade and financial transactions. The list includes currencies such as :

Chinese yuan (7.246300), Japanese yen (157.150000), Indian, rupee (83.065900), Korean won (1,381.600000), Kuwaiti dinar (0.306500), Omani rial (0.384500), Philippine peso (58.524000), Qatari riyal (3.640000), Saudi Arabian riyal (3.750000), Singapore dollar (1.351100), Thai baht (Not Available), U.A.E. dirham (3.672500), and Brunei dollar (1.351100).

For Europe: Euro (1.084200), U.K. pound (1.271450), Czech koruna (22.798000), Danish krone (6.879700), Norwegian krone (NA), Polish zloty (3.950100), Russian ruble (89.375500), Swedish krona (10.517890), Swiss franc (0.901100).

North America: Canadian dollar (1.363500), Mexican peso (17.633800), U.S. dollar (1.000000), Trinidadian dollar (6.706100)

South America: Brazilian natural (5.236700), Chilean peso (916.770000), Peruvian sol (NA), Uruguayan peso (38.786000)

Oceania: Australian dollar (0.664600), New Zealand dollar (NA).

These representative exchange rates, which are reported to the Fund by the issuing central bank, are expressed in terms of currency units per U.S. dollar, except for those indicated by (1) which are in terms of U.S. dollars per currency unit, the report stated.

Despite Nigeria’s compliance with its IMF obligations and having no outstanding payments, the country’s economic difficulties remain significant.

Read; UK’s Standard Chartered Accused of Funding Sanctioned Terrorist Entities

About The Author

Related Articles

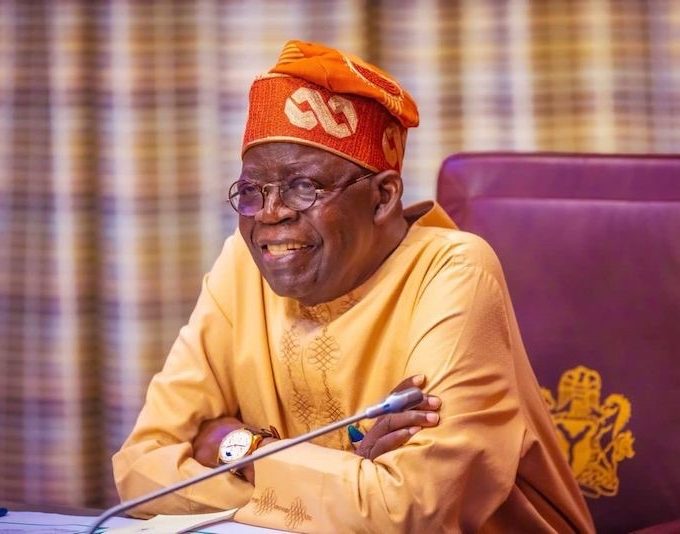

Tinubu Government Delays Release of Signed Tax Acts to the Public

Four days after President Bola Tinubu announced the signing of four tax...

ByMayowa DurosinmiJune 30, 2025As Tinubu Urges Africa-Caribbean Unity in Saint Lucia, Over 272 Nigerians Killed in June Alone

While Nigerians deal with deadly violence, worsening hunger, and mass flooding, President...

ByWest Africa WeeklyJune 30, 2025You Can’t Tax a Dead Economy: Nigeria Is Suffocating Under Its Own Policies

As Nigeria’s Central Bank clings to its benchmark interest rate of 27.5...

ByWest Africa WeeklyJune 30, 2025“Wike is Not a Blessing to Us, He’s a Disaster” — Workers Protest in Nigeria’s Capital Over Unpaid Wages, Poor Working Conditions

Staff members of the Federal Capital Territory Administration (FCTA) in Abuja barricaded...

ByOluwasegun SanusiJune 30, 2025