The African Development Bank (AfDB) has inaugurated the African Debt Managers Initiative Network (ADMIN) to address growing debt challenges in Africa. This move comes as the bank revealed that 13 African countries are at high risk of debt distress. Six are already in debt distress.

The initiative was launched during a peer learning event in Addis Ababa, focusing on “Developing and Deepening Domestic Debt Markets in Africa.”

According to AfDB Director Coulibaly Abdoulaye, ADMIN aims to provide “tailored and home-grown solutions” to the continent’s debt issues, strengthen debt management capacities, restore macroeconomic stability, and promote inclusive growth.

Eric Ogunleye, AfDB Institute Director, highlighted the factors driving Africa’s increasing debt. These include infrastructure development, poverty reduction, climate change mitigation, and tackling insecurity. He noted that “rising debt vulnerability and weak debt management capacity” in many countries worsen macroeconomic outcomes and disrupt effective policy responses to shocks.

As of 30 April 2024, of the 38 African countries for which debt sustainability assessment data are available, 13 countries are at high risk of debt distress, and six are already in debt distress, Ogunleye said.

He emphasised that a larger share of African debt is owed to external bondholders and non-Paris Club creditors. This has imposed a significant debt servicing burden averaging 18% of total government revenue.

Johan Krynauw, former Director of Debt Management at South Africa’s National Treasury, urged African countries to collaborate more closely on debt management issues, promoting knowledge-sharing and mutual support. He pointed out that despite many external institutional initiatives, public finance and debt management problems persist, and the continent now possesses the skills and experience to address these issues effectively.

The AfDB did not specify the countries currently in debt distress, but there have been significant concerns about Nigeria’s debt profile. With the World Bank’s recent approval of an additional $2.25 billion loan, Nigeria’s public debt has grown to $110.48 billion.

Read more: Apple Joins AI Icon Race With Ambiguous New Siri Logo

About The Author

Related Articles

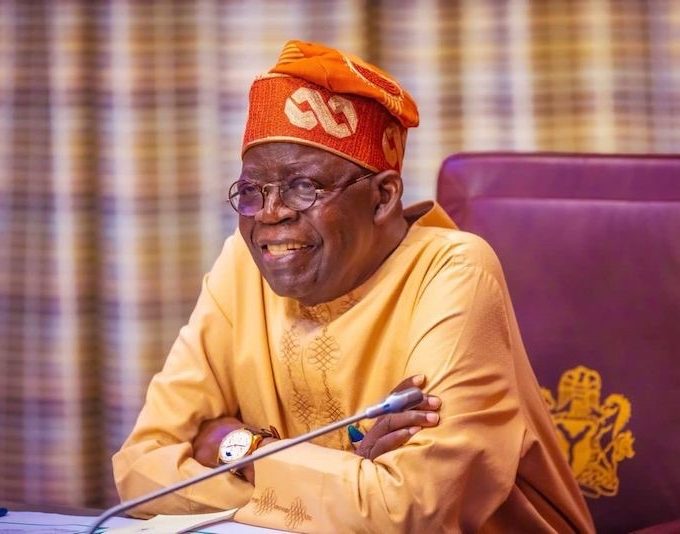

Tinubu Government Delays Release of Signed Tax Acts to the Public

Four days after President Bola Tinubu announced the signing of four tax...

ByMayowa DurosinmiJune 30, 2025As Tinubu Urges Africa-Caribbean Unity in Saint Lucia, Over 272 Nigerians Killed in June Alone

While Nigerians deal with deadly violence, worsening hunger, and mass flooding, President...

ByWest Africa WeeklyJune 30, 2025You Can’t Tax a Dead Economy: Nigeria Is Suffocating Under Its Own Policies

As Nigeria’s Central Bank clings to its benchmark interest rate of 27.5...

ByWest Africa WeeklyJune 30, 2025“Wike is Not a Blessing to Us, He’s a Disaster” — Workers Protest in Nigeria’s Capital Over Unpaid Wages, Poor Working Conditions

Staff members of the Federal Capital Territory Administration (FCTA) in Abuja barricaded...

ByOluwasegun SanusiJune 30, 2025