The Central Bank of Nigeria (CBN) has introduced a daily cash withdrawal limit of N100,000 for point-of-sale (PoS) terminals per customer.

The directive said to be part of its efforts to advance the cashless economy initiative and combat fraudulent activities was announced in a circular titled “Cash-out limits for agent banking transactions.” The apex bank directed deposit money banks (DMBs), microfinance banks, mobile money operators, and super-agents to comply with the new rules immediately.

“CBN sets cash withdrawal (cash-out) limit of N500,000 per customer across all channels. Transactions on PoS terminals are now restricted to a maximum of N100,000 per customer daily.

In view of the above, ALL principals of agents are to comply with the following directives immediately:

i. Issuers shall set a cash withdrawal limit (cash-out) per customer (regardless of channel) to N500,000.00 per week, ii. Ensure that all agent banking terminals are set to a daily maximum transaction cash-out limit of N100,000.00 per customer, “iii. Ensure that each agent’s daily cumulative cash-out limit shall not exceed N1,200,000.00,” the circular reads in part.

According to the CBN, agent activities must be carried out exclusively via float accounts maintained with the principals, with monitoring of associated BVNs to detect unauthorised transactions.

Daily transaction data, including limits and balances, must be electronically submitted to the Nigeria Inter-Bank Settlement System (NIBSS) in a prescribed format.

The circular emphasised that banks would be held fully accountable for their agents’ compliance with these directives.

Additionally, the CBN will conduct random oversight and back-end configuration checks to enforce adherence. The CBN warned that breaches of the directives would attract penalties, ranging from monetary fines to administrative sanctions.

About The Author

Related Articles

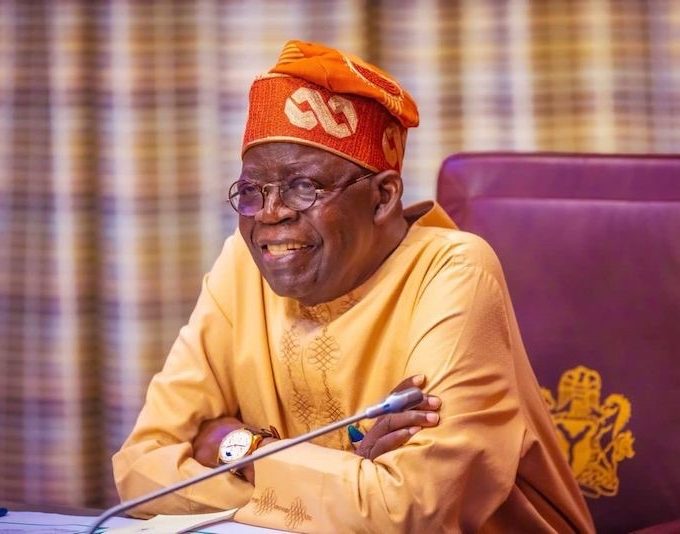

Tinubu Government Delays Release of Signed Tax Acts to the Public

Four days after President Bola Tinubu announced the signing of four tax...

ByMayowa DurosinmiJune 30, 2025As Tinubu Urges Africa-Caribbean Unity in Saint Lucia, Over 272 Nigerians Killed in June Alone

While Nigerians deal with deadly violence, worsening hunger, and mass flooding, President...

ByWest Africa WeeklyJune 30, 2025You Can’t Tax a Dead Economy: Nigeria Is Suffocating Under Its Own Policies

As Nigeria’s Central Bank clings to its benchmark interest rate of 27.5...

ByWest Africa WeeklyJune 30, 2025“Wike is Not a Blessing to Us, He’s a Disaster” — Workers Protest in Nigeria’s Capital Over Unpaid Wages, Poor Working Conditions

Staff members of the Federal Capital Territory Administration (FCTA) in Abuja barricaded...

ByOluwasegun SanusiJune 30, 2025

Leave a comment