Kenya’s government has amended the controversial Finance Bill 2024 and retracted several proposed tax hikes. This was in response to widespread opposition and public protests.

The amendments removed the proposed 16% VAT on bread, transportation of sugar, financial services, foreign exchange transactions, and the 2.5% Motor Vehicle Tax.

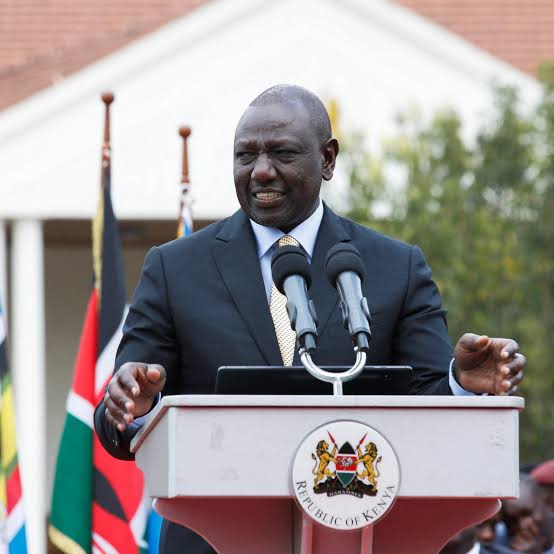

Announcing the changes, President William Ruto said:

“We are going to end up with a product in Parliament that came from the Executive and has been interrogated by the Legislature. Through public participation, the people of Kenya have had a say”.

The revisions also include maintaining mobile money transfer fees and removing the excise duty on vegetable oil. Additionally, levies on the Housing Fund and Social Health Insurance will not attract income tax. This is intended to increase disposable income for employees.

The Finance Bill imposes an Eco Levy only on imported finished products that contribute to electronic waste, such as phones, computers, and diapers. Locally produced items are to be exempted.

The threshold for VAT registration has also been raised from KSh5 million to KSh8 million. The Kenya Revenue Authority’s electronic invoicing requirement for small businesses with turnover below KSh1 million has been rescinded. The bill also introduces excise duty on imported table eggs, onions, and potatoes to protect local farmers.

Despite these amendments, the bill has faced strong opposition. On Tuesday, police used tear gas to disperse protesters near the parliament building in Nairobi. The protests, dubbed “Occupy Parliament,” led to 210 arrests, including journalists and human rights observers. Amnesty Kenya demanded the immediate release of all detainees.

Opposition leader Raila Odinga criticised the bill, urging legislators to remove clauses burdening the citizenry. He described the bill as “worse than the one of 2023″ and detrimental to millions of Kenyans’ investments and economic welfare.

As part of the amendments, the excise duty on alcoholic beverages will now be based on alcohol content rather than volume, and the pension contributions exemption will increase from KSh20,000 to KSh30,000 per month. The Finance Bill 2024 is targeted at generating an additional KSh302 billion in revenue but will undergo detailed scrutiny by lawmakers in upcoming sessions.

Read more: Kenya to Acquire $31M Surface-to-Air Missile Defence System from NATO-Aligned Israel.

About The Author

Related Articles

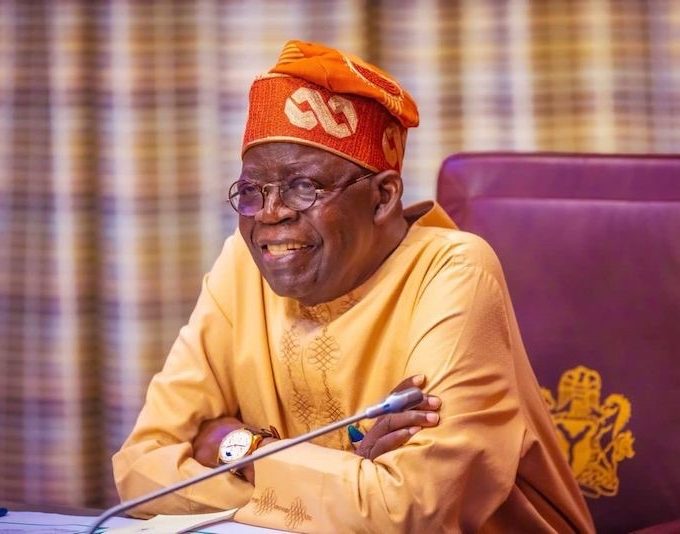

Tinubu Government Delays Release of Signed Tax Acts to the Public

Four days after President Bola Tinubu announced the signing of four tax...

ByMayowa DurosinmiJune 30, 2025As Tinubu Urges Africa-Caribbean Unity in Saint Lucia, Over 272 Nigerians Killed in June Alone

While Nigerians deal with deadly violence, worsening hunger, and mass flooding, President...

ByWest Africa WeeklyJune 30, 2025You Can’t Tax a Dead Economy: Nigeria Is Suffocating Under Its Own Policies

As Nigeria’s Central Bank clings to its benchmark interest rate of 27.5...

ByWest Africa WeeklyJune 30, 2025“Wike is Not a Blessing to Us, He’s a Disaster” — Workers Protest in Nigeria’s Capital Over Unpaid Wages, Poor Working Conditions

Staff members of the Federal Capital Territory Administration (FCTA) in Abuja barricaded...

ByOluwasegun SanusiJune 30, 2025

Leave a comment