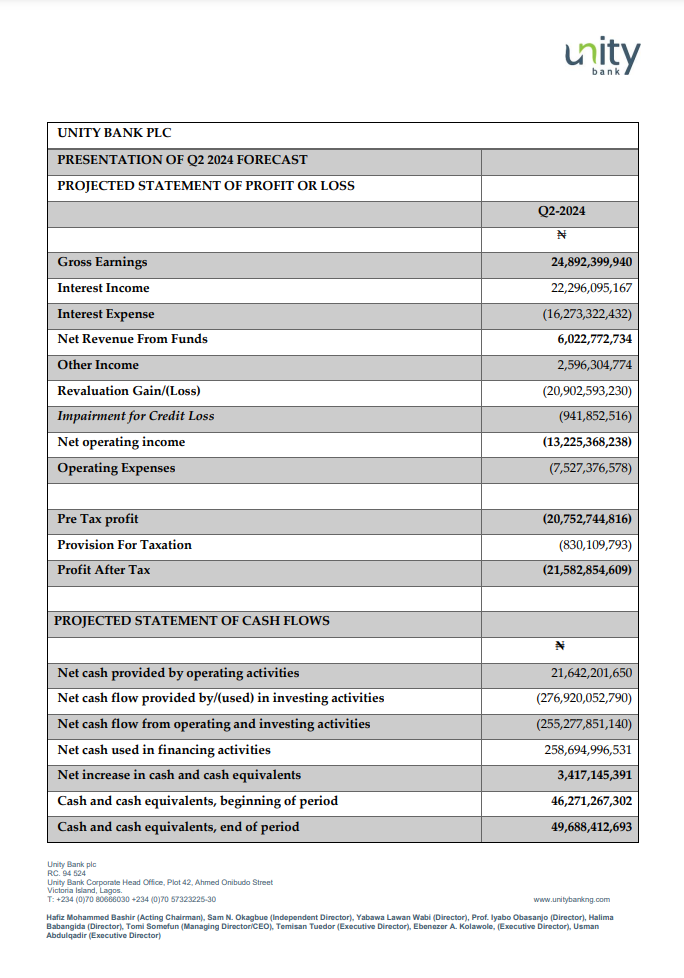

Unity Bank Plc released its financial earnings projections for the second quarter of 2024 on Monday. The company’s pre-tax record was a loss of N20.7 billion.

The bank’s negative performance has continued to erode shareholders’ funds, with a loss of N190.2 billion as reported on its financial statement, despite the risk of a potential merger.

In the press release obtained by West Africa Weekly, Unity Bank projects a closing cash position on its book at N49.6 billion, showing its financial strength and liquidity.

The bank also recorded a projected loss in December last year, a negative performance for 1st quarter (Q1) for this year amidst its fight to stay afloat in the financial markets.

In its second quarter (Q2), Unity Bank projects a capital loss of post-tax N21.58 billion, a pre-tax of N20.7 billion, a net operating loss of N13.23 billion, and an impairment credit loss of N941.85 million.

However, a projected N2090 billion loss in revaluation only indicates the revaluation and impairment credit losses would depreciate the bank’s profit to the negatives while it puts its gross earnings at N24.89 billion.

Essentially, Unity Bank’s projected net cash flow from operating and investing activities is expected to be at a loss of N255.28 billion. In contrast, the loss in net cash flow is to be provided and used in its investing activities at N276.92 billion.

Meanwhile, despite the current Managing Director/Chief Executive Officer, Tomi Somefun, pinning Unity Bank Plc’s financial struggle on the devaluation of the naira, the leading cause remains relative to the former Managing Director, Thomas Etuh, as earlier reported. This sets the precedent for the investigations of financial regulatory bodies, including CBN and Asset Management Corporation of Nigeria, AMCON.

Read: Exclusive: How Karu General Hospital Jailed two sisters for helping an unconscious woman

About The Author

Mayowa Durosinmi

author

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

Mayowa Durosinmi

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

Related Articles

Tinubu Government Delays Release of Signed Tax Acts to the Public

Four days after President Bola Tinubu announced the signing of four tax...

ByMayowa DurosinmiJune 30, 2025As Tinubu Urges Africa-Caribbean Unity in Saint Lucia, Over 272 Nigerians Killed in June Alone

While Nigerians deal with deadly violence, worsening hunger, and mass flooding, President...

ByWest Africa WeeklyJune 30, 2025You Can’t Tax a Dead Economy: Nigeria Is Suffocating Under Its Own Policies

As Nigeria’s Central Bank clings to its benchmark interest rate of 27.5...

ByWest Africa WeeklyJune 30, 2025“Wike is Not a Blessing to Us, He’s a Disaster” — Workers Protest in Nigeria’s Capital Over Unpaid Wages, Poor Working Conditions

Staff members of the Federal Capital Territory Administration (FCTA) in Abuja barricaded...

ByOluwasegun SanusiJune 30, 2025