The Central Bank of Nigeria and the Nigeria Deposit Insurance Corporation (NDIC) have come under fire from Heritage Bank depositors following the revocation of the bank’s operating license by the Central Bank of Nigeria (CBN).

Customers, including a young lawyer, Chikodi Okeorji, have expressed outrage over the NDIC’s decision to offer a maximum statutory insurance payment of N5 million per depositor.

The lawyer said he had deposited N17 million in Heritage Bank and lamented that the NDIC’s insurance coverage is inadequate and will leave many poor Nigerians and small businesses with significant losses.

He criticised the NDIC’s promise to pay the remaining funds after liquidation, stating that it is unlikely to materialise.

Depositors have also questioned the CBN’s decision to allow Heritage Bank to fail, citing the central bank’s previous interventions in cases like Skye Bank, where the Polaris Bank bridge bank structure ensured that depositors did not lose any funds.

Many customers have expressed disappointment in the CBN’s failure to keep its promise of never allowing banks to fail again.

The NDIC’s actions have raised concerns about the erosion of public faith in the banking system and financial stability.

Depositors argue that the CBN’s decision to revoke Heritage Bank’s license, despite its supervisory role, has shaken confidence in the regulatory framework.

Despite the House of Representatives’ pledge to engage with relevant stakeholders to ensure the safety of depositors’ funds and maintain financial system stability, the House Committee on Banking Regulations said it would closely monitor the liquidation process to protect depositors’ rights and ensure transparency.

However, this assurance seems not to pacify many depositors, who are worried about their funds and the refund process after liquidation.

So if I have 100M saved in a bank, and the CBN revokes their license… I’ll only get an initial refund of 5M until the sale of the bank’s assets is complete?????? pic.twitter.com/aLWo2w8XxU

— Alabi (@the_Lawrenz) June 4, 2024

Read; Naira Left Out Of IMF’s June Currency List

About The Author

Related Articles

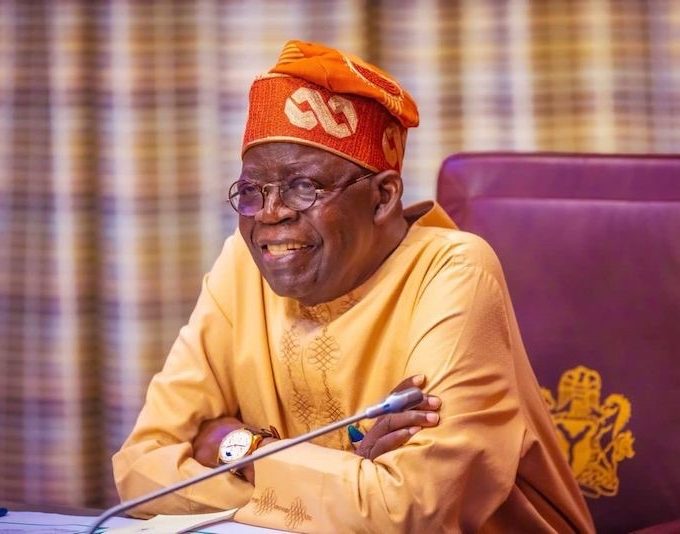

Tinubu Government Delays Release of Signed Tax Acts to the Public

Four days after President Bola Tinubu announced the signing of four tax...

ByMayowa DurosinmiJune 30, 2025As Tinubu Urges Africa-Caribbean Unity in Saint Lucia, Over 272 Nigerians Killed in June Alone

While Nigerians deal with deadly violence, worsening hunger, and mass flooding, President...

ByWest Africa WeeklyJune 30, 2025You Can’t Tax a Dead Economy: Nigeria Is Suffocating Under Its Own Policies

As Nigeria’s Central Bank clings to its benchmark interest rate of 27.5...

ByWest Africa WeeklyJune 30, 2025“Wike is Not a Blessing to Us, He’s a Disaster” — Workers Protest in Nigeria’s Capital Over Unpaid Wages, Poor Working Conditions

Staff members of the Federal Capital Territory Administration (FCTA) in Abuja barricaded...

ByOluwasegun SanusiJune 30, 2025